Intel, the largest semiconductor maker by revenue, has had an outstanding performance in the fourth quarter of 2023. The company’s latest financial report and outlook for the future have drawn significant attention from investors and analysts.

Stronger Than Expected Q4 2023 Results

In the quarter ended in December, Intel surpassed LSEG (formerly Refinitiv) consensus expectations, reporting an adjusted earnings per share of 54 cents, compared to the 45 cents that was expected. Additionally, the company’s revenue for the same period stood at $15.4 billion, exceeding the projected $15.15 billion. This exceptional performance has been a significant highlight for Intel.

Challenges in the First Quarter of Fiscal 2024

While Intel’s fourth-quarter results were impressive, the company’s outlook for the first quarter of fiscal 2024 fell short of analyst forecasts. Intel expects adjusted earnings per share of 13 cents on sales ranging between $12.2 billion and $13.2 billion, a significant disparity from the anticipated 33 cents per share on $14.15 billion revenue by LSEG. It is projected that the company will experience a net loss of 25 cents per share on a GAAP basis in the first quarter of fiscal 2024. Such projections have led to a decrease in Intel’s stock value.

Business Segments Performance

Intel’s core businesses, including PC and server chips, are expected to perform at the lower end of the company’s seasonal range in the current quarter. However, challenges are anticipated in subsidiaries such as

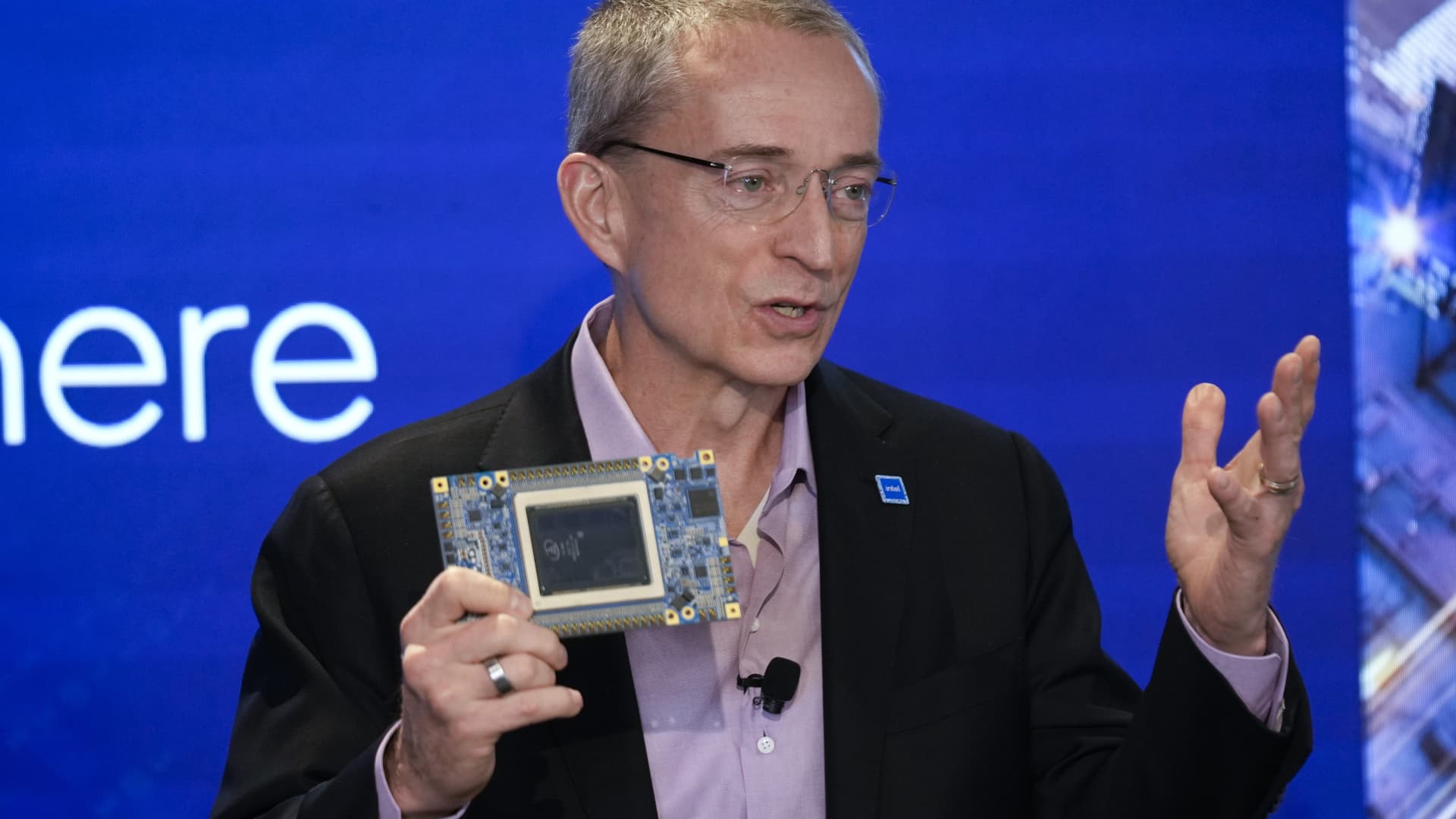

Mobileye and the programmable chip unit, leading to an overall impact on sales. Despite these challenges, CEO Pat Gelsinger remains optimistic about the company’s core business and product strength.

Strategic Shifts and Progress

Under the leadership of CEO Pat Gelsinger, Intel has been implementing a five-year plan focused on catching up to Taiwan Semiconductor Manufacturing Co. in offering manufacturing services to other companies, while also enhancing its own branded chips. The company has been cutting costs through workforce reductions and offloading small parts of its business. Moreover, Intel’s revenue from Intel Foundry Services, its business making chips for other companies, witnessed a 63% annual increase, indicating progress in its strategic initiatives.

Market Dynamics and Competition

The market dynamics in the semiconductor industry have been evolving, especially with the growing focus on artificial intelligence (AI) by cloud providers and large tech companies. This evolving landscape has seen a shift in the data center segment, with increased adoption of accelerators alongside central processors. This shift has impacted the dynamics between CPU and accelerators, which has implications for Intel’s future strategies and product offerings.

Intel’s largest division, the Client Computing group, which includes laptop and PC processor chips, experienced a 33% increase in sales, indicating positive momentum in the PC industry. However, the Data Center and AI division saw a 10% decline in sales, reflecting the evolving market trends and competitive landscape.

Conclusion

Intel’s performance in the fourth quarter of 2023 has been notable, with the company surpassing expectations in key financial metrics. However, the outlook for the first quarter of fiscal 2024 presents some challenges, particularly in subsidiary businesses and competitive market dynamics. As Intel navigates these challenges and continues to execute its strategic initiatives, the company’s ability to adapt to market changes and drive innovation will be crucial in shaping its future performance.